How the Budget will impact your finances

It is the last budget before the elections, the economy is stagnating and the Chancellor provided a mix of economic policies to support households and public finances and improve labour supply.

We discussed previously that the economy hasn’t faced its best days, with GDP per capita decreasing over the course of the last year which indicates the challenging position the households are in, and according to the Office of Budget Responsibility it will not recover to its pre-pandemic level till 2025.

Cuts to National Insurance contributions

The main policy that the Chancellor announced was the cut of the National Insurance contributions (NICs). The further 2p cut will benefit 27.6 million employees and 2.2 million self-employed workers at a cost of around £10 billion per year. But if you have a higher salary you will earn more in cash terms, for example if you have a salary of £30,000 your monthly take-home pay will go up by £29.04 from £2,064.30 to £2,093.34. This is 6.67% less tax than you have been paying. Or if you earn £60,000 your monthly take-home pay will go up by £62.82 from £3,717.01 to £3,779.83. This is 4.90% less tax than you have been paying.

Another point to note is that, as mentioned in Autumn, NICs cuts in practice just give back a portion of the money that is being taken away through multi-year freezes to tax thresholds according to Institute of Fiscal Studies(IFS) and the Resolution Foundation. IFS mentioned that “Overall, for every £1 given back to workers (including the self-employed) by the NICs cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024, with this rising to £1.90 in 2027.”

While the tax cuts will provide a short term relief for many households, adding a couple of additional pounds in their monthly budget, many economists consider the ‘opportunity cost’ of that decision. In more detail thinking about the benefits the amount spent for this tax cut could provide if they spent in an alternative policy. For example, the Financial Times reported that the decision will create “fiscal pain” after the election, as the government may struggle to meet its fiscal targets. In addition, other economists questioned the decision of tax cuts as a lost opportunity to invest more in the NHS or public infrastructure.

Non-dom tax status

However, the Chancellor found ways to fund the NICs cuts, by removing tax breaks. The policy is affecting non-domiciled (non-dom) people who live in the UK, but have their home overseas for tax purposes and do not pay UK tax on money they make elsewhere. So that tax break will be scrapped from April 2025. According to the OBR, only 10,500 people would be eligible for non-dom status in April 2025, well below the 68,800 registered with HMRC at present.

According to the Chancellor the new policy will “bring wealth earned overseas to the UK where it can be spent and invested”, and that the measure would “attract onshore an additional £15bn of foreign income and generate more than a £1bn of extra tax”. The Treasury has estimated that axing the current system would raise £2.7bn a year by 2028-29, in addition to the £8.5bn that non-doms pay in UK tax each year. Tax experts have in general welcomed the idea as a well-thought-out economic policy to provide an advantage to the UK by increasing the net inflow of wealth from overseas.

High Income Child Benefit Charge (HICBC)

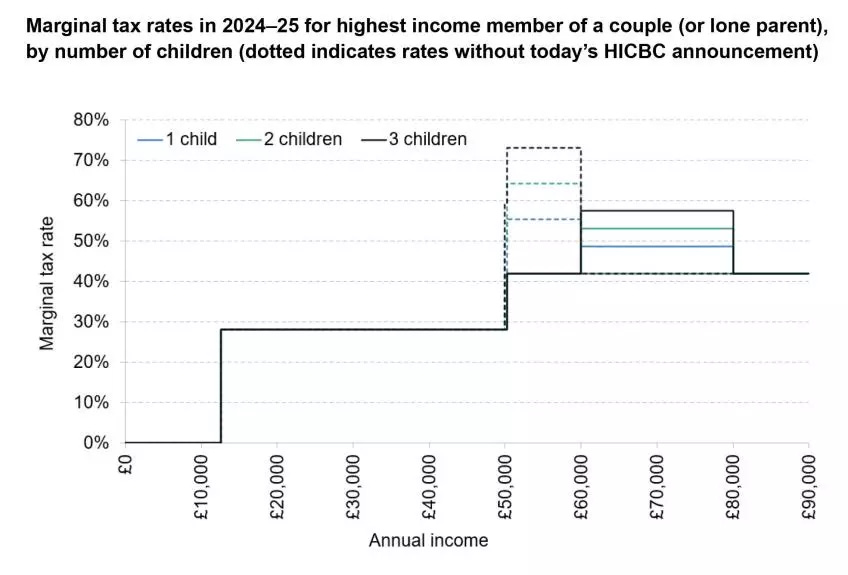

Another policy that affects the households is the changes to the threshold of High Income Child Benefit Charge. HICBC came in place in 2013 and under that tax, the child benefit received by higher earners – those earning more than £50,000 a year – is returned in part (or in some cases all of it) back through the tax system.

According to IFS, increasing the point at which families start losing child benefit from £50,000 a year (for the highest-income parent) to £60,000 will mean that about 170,000 fewer families will be affected in 2024–25. The government estimates that 485,000 families will gain an average of £1,260 in child benefit in the 2024-25 tax year as a result of the changes. The HICBC creates particularly high effective marginal tax rates for those with several children. This will remain the case but the impact will be lessened, as shown by the chart below from IFS.

The government is going to follow a consultation on how to improve child benefit and reform HICBC based on the household income rather than solely focusing on the income of the highest earner. The new design may take into consideration how the income is distributed between the parents and take into consideration any inequalities that the current design doesn’t.

According to the Resolution Foundation, the biggest losers from yesterday’s budget are the wealthy. It found that the top fifth of the income distribution will lose out by an average of £1,500 by 2027-28, while the typical household will gain £420.

The other losers of the budget policies are pensioners. As pensioners do not pay NICs, they will not benefit from the tax cuts announced yesterday but they are still affected by the freezing of tax thresholds. The Resolution Foundation suggested that overall the policy changes during recent years will increase taxes paid by pensioners by about £8bn.

To sum up, the Budget seems to provide a mix of policies that put the wealthy into a worse situation than they were before, while it is giving some tax relief to the average household. Following policies and tax reforms it also provides an increased revenue that could support the tax cuts.