Many of us have been anticipating the Autumn statement, a very important one as it will drive the political agenda through the next election. But it is not the only reason - after years of economic shocks such as COVID and the wars in Ukraine and Gaza, some of us are looking for some stability, extra cash in our pocket and some interventions that will make us see the future with a more positive look. Did the Autumn statement deliver that? The picture is mixed as always, there is some very good news that supports individuals and households but the economic outlook is still very volatile.

National Insurance Contributions

One of the main policies announced was the cut in National Insurance Contributions (NIC). The government has stated its aim to reduce personal taxes as much as possible, however higher prices and rising debt haven’t previously allowed the government to do so.

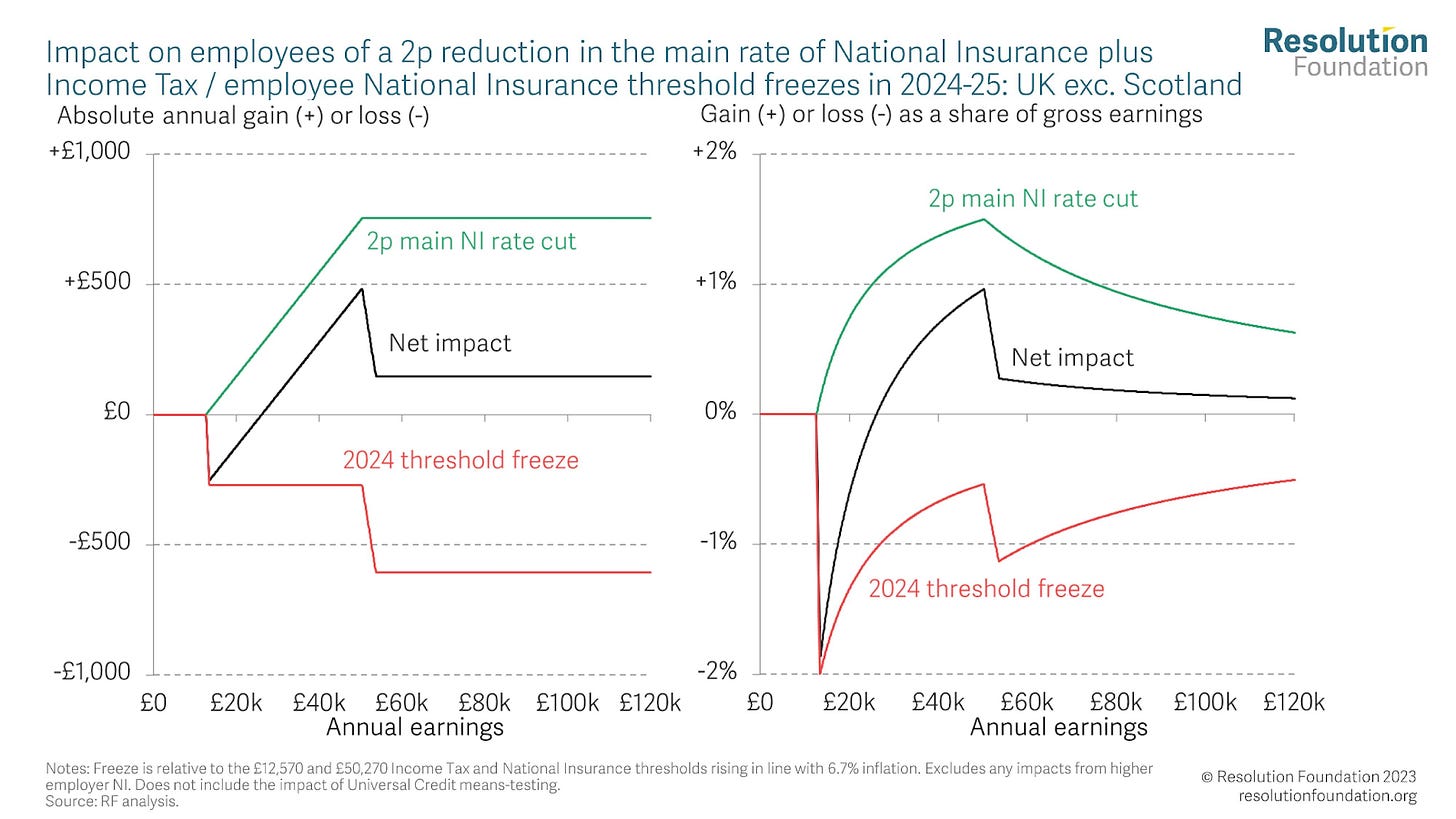

The National Insurance cut will bring money back in our pockets, with around 30 million workers benefiting from it. For example, someone with an average salary of £35,000 may save about £450 a year through not having to pay the 2% of NIC which will be cut in January 2024. That will be the short term effect that we will see in our pockets. But how is the picture changing when we take into account the impact of all the different tax policies implemented over the last few years?

Unfortunately, economists claim the overall picture looks less positive. Yes many of us will get a few extra pounds next year because of lower NIC, but this will be offset from the fact that the income tax thresholds will not be changed according to inflation up to 2028.

The thresholds determine how much tax you pay, for example there is a tax free threshold of £12,570 for which we don’t pay any tax or NIC. Income tax and NIC thresholds used to increase according to inflation; however this is not going to happen for many years. If it had happened this year, the tax free threshold would have increased by at least 6% which would have benefited many households. Also, as workers saw their wages rising last year, this meant that more people will have to pay extra income tax because of the frozen thresholds, at the same time as having extra monthly expenses due to the cost of living crisis.

According to the Resolution Foundation “households will on average be £1,200 worse off overall” and “only those earning around £11,000 to £13,000, and £42,000 to £52,000, will be better off.”

Increasing Benefits and Minimum Wage

That is good news for the people relying on benefits or the minimum wage. As I explained in a blog last month, the minimum wage has supported those in low paid jobs to make ends meet, especially during the high inflation period we face. Increasing benefits in line with inflation gives extra support to households that are struggling, but it is also a boost for the economy, as the money that the households receive from benefits they spend on them, and more spending is boosting the economy.

But one of the most important announcements was the increase of Local Housing Allowance Rates that have been frozen for years. The increase in housing benefits will help many people to be able to afford their rent. Rents have increased dramatically the last year, especially in London, and are expected to increase even more. The increase in housing benefits give a short term boost to the finances of people that are really needed, however the Chancellor mentioned that the housing benefits will freeze again from next year. This may put low income families in a worse position again in the future based on the continued increase of housing costs.

Last but not least the Reforms to the Work Capability Assessment will see around 370,000 fewer people classified as being in the ‘more severe’ group which receives an extra amount of benefits because of the long term illness that they face. According to the Health Foundation this measure will not have a consequence of more people moving into work, only about 2.7% of those affected may return to the labour market. There may be a very small increase in the public finances, but it will affect the well-being of thousands in disability benefits with extra stress and may lead to deterioration of the already fragile mental health of this group.

Household Income

But what is the impact of all these measures and the economic situation to our incomes? Unfortunately our living standard is expected to continue deteriorating over the next few years. The Office for Budget Responsibility (OBR) assessed that the situation is better than was expected in March, but still the household disposable income per person will fall by 0.8 per cent in the financial year 2023-24, following a fall of 2.2 per cent in the financial year 2022-23, and falling even more over the next few years. OBR mentioned that the cut in taxes, especially the reduction in NIC described above will increase the income of households, however the freeze of thresholds will continue to disproportionately affect the income of households for many years to come.

Resolution Foundation estimates that household disposable income will fall by 3.1 per cent from December 2019 to January 2025; in monetary terms this means that households will, on average, be £1,900 poorer during that period. This is because of a combination of economic shocks that we have been facing in recent years and despite the government's efforts to cut taxes, the amount of money in our pockets will still be lower.