In a galaxy far far away the emperor has triumphantly reinstated to his throne with the vast support of people. After four years in exile he doesn’t lose a moment and immediately starts the Trade Wars by increasing the tariffs on the neighbouring galaxies’ products. The other galaxies hit back with the same tariffs, while the politically unstable and economically stagnant Western European Alliance of galaxies waits for the Emperor’s tariff attack and their involvement in the Trade Wars. Who is going to win the battle of tariffs - and are there any Jedi left?

But we don't live in another Star Wars sequel, as much as some of us would prefer it. Donald Trump has returned and started implementing his political agenda. One of the first policies was to introduce 25% tariffs on products imported from Mexico, Canada and 10% extra on products from China, with more tariffs to the EU to come during the next months. But what actually are tariffs, are they useful for the American economy and how will it support the common people?

What are tariffs?

In an era of free trade, we need to start with the absolute basics. What are these so-called tariffs, that we haven’t heard about for some years in the EU? In very simple words it is an extra amount of money that someone producing a product in, say, Mexico will have to pay if they want to sell their product in the USA starting next month. This money is going into the US government and the government administration is responsible for collecting them as with all other taxes.

Let’s take the example of the new tariffs the US imposed into Chinese products. If a pair of jeans produced in China is imported to the USA for the price of $10, from Tuesday they will have to pay an extra 10% tariff to the federal government, which will be $1, increasing immediately the price of the pair of jeans from $10 to $11. If we account $9 for expenses and profit that the US importer will apply then the final price of the jeans for the consumer will be $20 instead of the $19 it would have cost before the tariffs.

Tariffs are not a new idea at all, though they have fallen out of favour after World War II with the US starting to encourage a more free trade system, as tariffs make products more expensive and potentially discourage trade. But before that, tariffs were one of the main contributors to make the US a more industrialized economy. Historically, in the US from 1790 to 1860, tariffs produced 90 percent of federal revenue. Between 1861 and 1933, the US had one of the highest average tariff rates on manufactured imports in the world. Tariffs served three main objectives for the US economy: increase revenue from imports, restrict imports, protect and give space to the domestic industry to develop. When the US manufacturing industry was strong enough and less affected by external factors, the government started promoting a free trade system.

Why is Trump imposing tariffs?

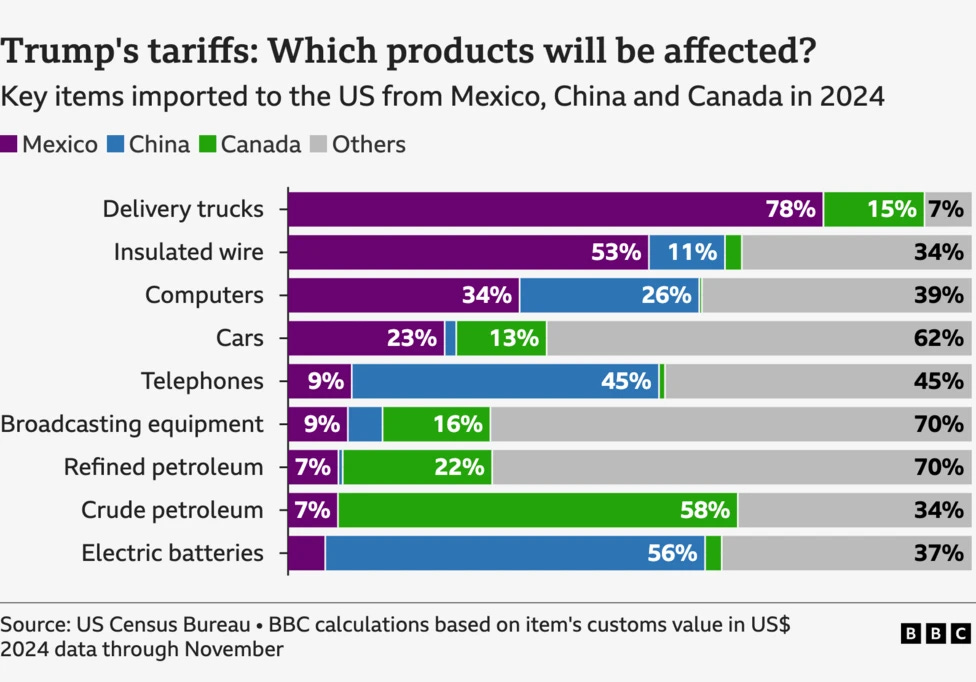

Imposing tariffs on Mexico, China and Canada first makes economic sense as these three countries account for a little more than 40% of US imports, valued at more than $2 trillion. So if the argument is to support the public finances, it is very well targeted. Higher tariffs imposed on products from these countries, especially Mexico and Canada, will have an impact to increase revenue for the US. Because of the geography and the close proximity of the countries, there still will be a continuity in the trade relationship despite the increase in tariffs. During the previous Trump administration, the introduction of the 25% levy on steel and 10% tariff on aluminium, supported the public finances. In 2019, $79bn of revenue was generated in tariffs, double the value from 2017.

The other idea is supporting the local industry and boosting local production. In principle, by imposing tariffs on imports, Trump allows US industries to compete with the production of other countries which in some cases is cheaper because of the lack of regulation in the country that they are produced. By making imports more expensive, consumers are expected to switch their preferences into more domestic production. The increased revenue into domestic industries will support their expansion, creating job growth and investment in innovation, as happened in the US before World War II. Another benefit expected from introducing tariffs is the increased investment from foreign companies into the US, if it is getting more expensive to import the goods they may decide to move the production in the US. Moving the production internally will create more jobs for Americans.

Sounds very good doesn’t it? Let's speak a little more about the drawbacks of these policies,=. Introducing tariffs means increasing prices as we mentioned in the example earlier. Increasing the price of goods is not good for the everyday consumer, as they will be able to afford fewer products. Increasing the prices of imports doesn’t mean that the prices of domestic goods will remain the same, they will increase accordingly as there is a greater opportunity for them to make a higher profit. Prices of other products will increase too, as raw materials and complementary products will start seeing higher prices as well. The consequence will be a squeeze in the finances of households, which may have consequences for the new administration as inflation has been the main concern of the voters. So as a summary, there may be economic benefits from introducing tariffs but households will have to face the immediate consequences of them, while long term economic benefits will be affected by what other countries do to support their industries and trade.

The Trade Wars have just begun, there will be months of negotiations between countries trying to bargain on tariffs between them, all of this in a period of political and economic uncertainty while a war is still going on in Europe, and with households already feeling the economic consequences in their pockets. If there is a Jedi somewhere in the universe, I think this is the moment to use the economic Force and bring stability to the galaxy.